Friday, September 30, 2011

Sunday, September 4, 2011

Forex Forecast : Rate Predictions For GBP, USD, EUR, AUD, CAD

STORY LINK Forex Forecast : Rate Predictions For GBP, USD, EUR, AUD, CAD

Forex Forecast : Rate Predictions For GBP, USD, EUR, AUD, CAD

POUND STERLING

This morning?s PMI survey showed that the UK?s manufacturing output continued to contract last month as demand for British exports in foreign markets dropped off. With the latest Halifax house price survey showing an unexpected dip in UK property prices, most analysts would have expected the Pound to come under selling pressure. However, the Pound has shown some resilience to hold its own against the other majors. NEAR-TERM OUTLOOK ? NEUTRAL TO NEGATIVE.

US DOLLAR ? The Pound Dollar exchange rate (GBP/USD) is 1.6221

This afternoon?s US employment sector data came out broadly as per expectations, showing that conditions in the American market remain soft. If tomorrow?s Non-Farm Payrolls figure confirms that job generation in the world?s leading economy remains slow, then institutional investors may turn against the Greenback, halting its recent forward move in the currency markets. NEAR-TERM OUTLOOK ? NEUTRAL.

EURO ? The Pound Euro exchange rate (GBP/EUR) is 1.1351

The Euro has come under some selling pressure in the currency market today following this morning?s release of finalised German GDP figures for the three months to June. The numbers showed that German exports remained strong during this period, however other components of the numbers hinted at weakness in Germany?s domestic economy ? bad news for the Eurozone as a whole and for its single currency. NEAR-TERM OUTLOOK ? NEUTRAL TO NEGATIVE.

AUSTRALIAN DOLLAR ? The Pound Australian Dollar exchange rate (GBP/AUD) is 1.5147

Chinese manufacturing figures, released during last night?s Asian session, came out worse than had been anticipated, which is never good news for Australian exporters and European equities markets have lost ground so far today, hinting a softening in appetite for risk. The high-yielding Australian Dollar has not suffered any significant downside as of yet, however further disappointing data releases, or stock market losses, could cause the Aussie to come under selling pressure. NEAR-TERM OUTLOOK ? NEUTRAL.

CANADIAN DOLLAR? The Pound Canadian Dollar exchange rate (GBP/CAD) is 1.5843

The Canadian Dollar has enjoyed a strong start to today?s session, causing the GBP CAD rate to drop by almost a cent from its overnight high at one point. The move has partly been driven by a move forward in the price of crude oil over the past few sessions and by yesterday?s better-than-anticipated US Factory Orders data, hinting at a potential for strong future demand for Canadian commodities. NEAR-TERM OUTLOOK ? NEUTRAL TO POSITIVE.

For other live currency exchange rates and a currency converter see the currency news website.

TAGS: American Dollar Forecasts Australian Dollar Forecasts Canadian Dollar Forecasts Currency Predictions Euro Forecasts Pound Australian Dollar Forecasts Pound Canadian Dollar Forecasts Pound Dollar Forecasts Pound Euro Forecasts Pound Sterling Forecasts

Source: http://www.currencynews.co.uk/forecast/20110901-713_forex-predictions-gbp-usd-eur-aud-cad.html

Forex Trading Signals Forex Strategies Forex Trading Strategies Currency Trading Forex Signal Service

What I See in FX Market

$EURUSD

WHAT ProAct Traders SEE: We are currently sitting @ 1.4196 just above the day chart trend wall. We are in a nice downtrend but could bounce on the day chart trend line. There is strong support in the 1.4156 area ( S5). We are expecting a bounce there to the .382 Fibo ( 1.4310) but cannot rule out continuation of the downtrend through the day chart trend line. If we get the break of the day chart trendline look for the 1.4100 initial target and then the 1.270 Fib extension @ 1.4053. The average daily trading range for the cross currently is 132 pips.

???????????????????????????

$USDJPY

WHAT ProAct Traders SEE: We are currently @ 76.82. The cross is sitting just above the a strong countertrend line and has formed a wedge so we are looking for a move back to the double bottom (intervention territory) @76.00. The average daily trading range for the cross currently is 59 pips.

???????????????????????????

$GBPUSD

WHAT ProAct Traders SEE: We are currently @ 1.6225. The cross bounced on the bottom and currently just above the day chart trend line and below the .382 fibo. A break of the .382 Fibo up look for Targets north: look for the ..618 Fibo @ 1.6318 then the R4 @ 1.6361. The average daily trading range for the cross currently is 129pips.

???????????????????????????

$AUDUSD ? A great smooth currency for Newbie?s!

WHAT ProAct Traders SEE: We are currently @ 1.0655. The cross has started a pullback to the Day chart trend line. We are expecting a correction to the .618 Fibo ( 1.0554) but could pull up at the .500 @ 1.0595. A break to the downside would mean a deeper correction an would look for the 1.0430 if that happened. The targets up are double top @ 1.0766, the 1.270 Fibo @ 1.0860. The average daily trading range for the cross currently is 106 pips.

Source: http://www.fxstreet.com/technical/analysis-reports/what-i-see-in-fx-market/2011-09-03.html

Forex Weekly Outlook ?September 5-9

This week?s most important events are the rate decisions in Australia, Japan, Canada, the UK and in the �Euro-Zone and employment data in Australia, �and Canada. Here is an outlook on all the major events awaiting us this week.

Last week the overall picture in the US has worsened after a flat reading of non-farm payrolls indicating no new Jobs were created in August. This is the weakest figure in almost a year, much lower than the 74,000 jobs expected by analysts. However, this reading was affected by the strike at Verizon artificially decreasing 45,000 jobs from the payrolls. Another positive sign is ADP report published two days ago, has shown a gain of 91K.

Let?s Start

- Australian rate decision:�Tuesday, 4:30. The Reserve Bank of Australia maintained the cash rate at 4.75% despite growing concerns over the growing inflation and global uncertainties. No changes are expected.

- US�ISM Non-Manufacturing PMI:�Tuesday, 14:00. ISM Non-manufacturing index decreased to52.7 in July after53.3 in the previous month. Indicating further growth but at a slower rate in the non-manufacturing sector. A small drop to 51.5 is expected.

- Australian GDP:�Wednesday, 1:30.Australia?s economy shrank in the first quarter by 1.2% following floods which affected exports. Exports plunged 8.7% subtracting 2.1 percentage points from GDP growth. Nevertheless the economy is expected to rebound in the second quarter. An expansion of 0.1% is predicted.

- Japan�rate decision:�Wednesday. The�Bank of Japan�held its�overnight call rate at a range of 0 to 0.1% by a unanimous vote. �However the BOJ has decided to increase the asset purchase program by 10 trillion to 50 trillion yen. � Further monetary easing is essential for a successful recovery according to BOJ members. The same rate is forecasted.

- Canadian Rate decision;�Wednesday, 13:00. The Bank of Canada left its overnight rate at 1.0%. Canada?s economic expansion is continuing in line with predictions with strong household spending but weaker experts due to reduced US demand. No changes are predicted.

- Australian employment data:�Wednesday, 1:30.�Australian economy did not add any jobs in July but contracted 100 positions. This reading was contrary to the 10,000 additional positions predicted by analysts. Full time employment dropped by 22,200 while part-time employment increased by 22,100. The unemployment rate climbed to 5.1% from 4.9% in the previous month. This rise in unemployment indicated that the boom from the global recovery has subsided. 10,400 new jobs are expected and Unemployment is predicted to remain 5.1%.

- UK�rate decision:�Thursday, 11:00. All MPC members voted to maintain interest rates at 0.5% which further distances the possibility of future rate hikes. Moreover a future quantitative easing plan was discussed as a possible option. Decreasing global demand and financial crisis in world markets will reduce inflation pressures. No change is foreseen.

- Euro-Zone rate decision:�Thursday, 11:45. European Central Bank has decided to keep interest rate at 1.50% and buy more Italian and Spanish sovereign bonds in order to fight the euro-zone debt crisis. The same rate is expected to be maintained.

- US Trade Balance:�Thursday, 12:30.�TheU.S. trade deficit widened to $53.1 billion in June from $50.8 billion in the previous month, the largest deficit in almost three years. This unexpected increase in deficit was contrary to predictions of a possible improvement to $48.2 billion. Exports as well as imports have declined. Deficit is expected to decrease to $49.7 billion.

- US Unemployment Claims:�Thursday, 12:30. New applications for unemployment dropped by 12,000 last week to 409,000. The average of new claims over the past four weeks increased to 410,250 indicating that the US job market is still weak.A further drop to 408,000 is predicted.

- Canadian employment data:�Friday, 11:00. Canada?s unemployment rate dropped to 7.2% percent in July, its lowest since December 2008, from in June, with improvement in job creation rising by 7,100 after 28,400 surge in the previous month. This is good news for the Canadian job market. An increase of 31,400 jobs is expected with an increase on Unemployment rate reaching 7.3%.

That?s it for the major events this week. Stay tuned for coverage on specific currencies

*All times are GMT.

Source: http://www.fxstreet.com/fundamental/market-view/forex-weekly-outlook/2011-09-03.html

Spain is closer to controls on budget

Source: http://feedproxy.google.com/~r/forexlive-rss/~3/U5xteWWWwxg/

Forex Strategies Forex Trading Strategies Currency Trading Forex Signal Service Forex

Saturday, September 3, 2011

Individuals Who Are Not Authorized to Work in the United States Were Paid $4.2 Billion in Refundable IRS Credits

According to a Treasury Inspector General audit, Individuals Who Are Not Authorized to Work in the United States Were Paid $4.2 Billion in Refundable Credits

American Recovery and Reinvestment Act of 2009 Made Fraud EasierRedaction Legend:

1. Tax Return/Return Information

2(f). Risk circumvention of agency Regulations or StatutesIMPACT ON TAXPAYERS

Many individuals who are not authorized to work in the United States, and thus not eligible to obtain a Social Security Number (SSN) for employment, earn income in the United States. The Internal Revenue Service (IRS) provides such individuals with an Individual Taxpayer Identification Number (ITIN) to facilitate their filing of tax returns. Although the law prohibits aliens residing without authorization in the United States from receiving most Federal public benefits, an increasing number of these individuals are filing tax returns claiming the Additional Child Tax Credit (ACTC), a refundable tax credit intended for working families. The payment of Federal funds through this tax benefit appears to provide an additional incentive for aliens to enter, reside, and work in the United States without authorization, which contradicts Federal law and policy to remove such incentives.

WHAT TIGTA FOUND

Claims for the ACTC by ITIN filers have increased from $924 million in Processing Year 2005 (the calendar year in which the tax return was processed) to $4.2 billion in Processing Year 2010. Clarification to the law is needed to address whether or not refundable tax credits such as the ACTC may be paid to those who are not authorized to work in the United States. *********************2(f)*********************************** Also, employees in the Accounts Management Taxpayer Assurance Program are not taking steps to notify taxpayers when it is obvious their SSNs and names have been compromised.

TIGTA also found that a feature on tax preparation software programs which automatically takes the taxpayer identification number and enters it as the identifying number for the taxpayer?s Wage and Tax Statements ******************2(f)*************************************.

WHAT TIGTA RECOMMENDED

TIGTA recommended that the IRS work with the Department of the Treasury to seek clarification on whether or not refundable tax credits may be paid to individuals who are not authorized to work in the United States. TIGTA also recommended the IRS require individuals filing with ITINs and claiming the ACTC to provide specific verifiable documentation to support that their dependents meet the qualifications for the credit, including residency, and that questionable Child Tax Credit (CTC) and ACTC claims on ITIN returns **********2(f)*******************************. The IRS should also notify taxpayers when their SSNs are compromised and ensure that software packages do not auto-populate an ITIN onto Wage and Tax Statements.

IRS management agreed to discuss with the Department of the Treasury the issue of ITIN filers? ACTC eligibility. The IRS did not agree to require additional documentation to support CTC and ACTC claims on ITIN returns ********************2(f)*********************************** The IRS is exploring options to alert taxpayers whose SSNs have been compromised and plans to address software that auto-populates an ITIN onto Wage and Tax Statements and take sanctions for noncompliance.

The Washington Post commented on the fraud in Undocumented workers got billions from IRS in tax credits, audit finds

Fraud and government programs go hand-in-hand.Sen. Orrin Hatch (R-Utah), ranking member of the Senate Finance Committee, On Friday announced plans to examine the refunds.

?The disconcerting findings in this report demand immediate attention and action from Congress and the Obama Administration,? Hatch said in a statement.. ?With our debt standing at over $14.5 trillion and counting, it?s outrageous that the IRS is handing out refundable tax credits...to those who aren?t even eligible to work in this country.?

Wage earners who do not have Social Security numbers and are not authorized to work in the United States can use what the IRS calls individual taxpayer identification numbers. Often these result in fraudulent claims on tax returns, auditors found.

Their data showed that 72 percent of returns filed with taxpayer identification numbers claimed the child tax credit.

Changes to tax law are partly to blame for the explosion in refunds for additional child tax credits in recent years, auditors found. Before 2001, filers needed to have three or more children to qualify ? and to owe more Social Security taxes than earned income credits.

But those requirements have been eliminated and the allowable refund for each child doubled. The American Recovery and Reinvestment Act of 2009 also made the refund easier to get, auditors found.

In my opinion we should kill this ridiculous program entirely. The next best alternative is to not grant any credits to anyone who does not have a social security number and is not a US citizen.

Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Global economy in ?danger zone? ? Zoellick

Source: http://feedproxy.google.com/~r/forexlive-rss/~3/yRsE3FPd2qk/

Trading Week Outlook: Sep. 5 - Sep. 9

In preparation for the new trading week, here is a list of the Top 10 spotlight economic events that will move the markets around the globe.�

1.��� AUD- Reserve Bank of Australia Interest Rate Announcement, Tues., Sep. 6, 12:30 am, ET.

Just until a few weeks ago, the market was pricing a Reserve Bank of Australia rate cut, but following the RBA Governor?s recent statement that ?inflation bears careful watching? and that the global economic situation ?is not that bad? these expectations have changed. While the Reserve Bank of Australia would not be likely to make any changes to its current monetary policy and is forecast to keep the benchmark rate at 4.75%, if the statement following the monetary policy meeting echoes the RBA Governor?s optimistic outlook, the Aussie dollar could see an opportunity to resume its upward trend against the greenback.

2.��� CHF- Swiss CPI- Consumer Price Index, the main measure of inflation preferred by the Swiss National Bank, Tues., Sep. 6, 3:15 am, ET.

The record high Swiss franc is not only bad for the economy but it is also deflationary. Should the inflation gauge head lower again, this could give the Swiss National Bank another reason to step up efforts to curb the strength of its currency. The Swiss CPI declined 0.8% m/m in July bringing the annual rate to 0.5% y/y from 0.6% y/y in June and it is forecast to see another 0.1% m/m drop in August.�

�

3.��� EUR- Euro-zone GDP- Gross Domestic Product, the main measure of economic activity and growth, Tues., Sep. 6, 5:00 am, ET.

The revised reading of the Euro-zone GDP is expected to confirm the preliminary estimate that economic growth was four times slower at 0.2 % q/q in the second quarter of 2011, compared with 0.8% q/q in Q1 2011.

4.��� USD- U.S. ISM Non-Manufacturing Index, a leading indicator of economic conditions in the services industries: agriculture, mining, construction, transportation, communications, wholesale trade and retail trade, Tues., Sep. 6, 10:00 am, ET.

As the ISM Manufacturing PMI surprisingly held above 50 in August, activity in the U.S. services industries is forecast to follow suit and expand for another month with an ISM index reading of 51.5 in August, down from 52.7 in July.��

5.��� AUD- Australia GDP- Gross Domestic Product, the main measure of economic activity and growth, Tues., Sep. 6, 9:30 pm, ET.

Hit by massive floods, the Australian economy unexpectedly shrunk by 1.2% q/q in the first quarter of 2011 from 0.8% q/q in Q4 2010, but is expected to recover and grow by 1.0% q/q in the second quarter of 2011. A return to growth could keep the higher-yielding Australian dollar well bid, especially if risk appetite makes a comeback.�

6.��� JPY- Bank of Japan Interest Rate Announcement, Wed., Sep. 7, around 12:00 am, ET.

The Bank of Japan is not expected to make any drastic changes to its monetary policy, keeping the benchmark rate at its record low level of 0.10%. However, with the dollar lingering near post WWII lows against the yen, it would not be surprising to see the Bank of Japan reassuring the markets of its commitment to do whatever is necessary in order to prevent any rapid yen appreciation.����

7.��� CAD- Bank of Canada Interest Rate Announcement, Wed., Sep. 7, 9:00 am, ET.

Perhaps the least interesting of the five central bank announcements next week, the Bank of Canada?s meting could end up being a formality with consensus forecasts anticipating policy makers to maintain the status quo, while expressing concerns about the negative impact of the deteriorating economic conditions in the U.S. which is Canada?s largest trading partner. It would be a shocker (and a Canadian dollar negative), but there might be some chance that the Bank of Canada warns that further U.S., Canadian and global economic slowdown could warrant a rate cut in the near future.�

8.��� AUD- Australia Employment Situation and Unemployment Rate, the main gauge of employment trends and labor market conditions, Wed., Sep. 7, 9:30 pm, ET.�

The third major spotlight event from ?down under? next week could give the Aussie dollar an additional boost with the Australian economy forecast to recover from the 100 jobs lost in July by adding up to 10,400 new jobs in August, while the unemployment rate remains unchanged at 5.1%.�

9.��� GBP- Bank of England Interest Rate Announcement, Thurs., Sep. 8, 7:00 am, ET.���

The latest unanimous vote by the Monetary Policy Committee to keep the benchmark rate at the low 0.50% level has made it clear that the Bank of England does not see any urgency to raise interest rates and the September meeting is likely to bring more of the same. A passive Bank of England expected to sit on the sidelines for another month could contribute to the case for GBP weakness ahead of the BOE meeting and possibly even after that if the bank announces or opens the door to an expansion of its Asset Purchases Program. On the other hand, if the bank of England refrains from additional quantitative easing, when the market rout and the risk aversion dust settles, the GBP could begin to be viewed as a less ugly alternative to the USD and the EUR.

10.��� EUR- European Central Bank Interest Rate Announcement, Thurs., Sep. 8, 7:45 am, ET.���

With the Euro-zone economy slowing and inflationary pressures subsiding, the EUR could see selling pressures mounting ahead of the European Central Bank's meeting as the market shifts its expectations for another rate hike by the end of the year and begins to more aggressively price a potential rate cut in the near future. A dovish ECB statement, coupled with fears that Greece would miss its budget deficit targets for the year which might move the country one step closer to exiting the monetary union, could continue to weigh on the single currency next week.

Source: http://www.fxstreet.com/fundamental/market-view/the-trading-week/2011-09-03.html

Economy Finance Forex Trading Forex Signal Free Forex Signals

Fear vs Reality

Lessons from the Pros

Subscribe to the Weekly Newsletter published by Online Trading Academy. Receive the full newsletter with charts!A lot of Mail box stuff caught up and then Mike and Justin took a hard look at the USD Index and some possible plays in the Swiss Franc after the SB?s Intervention.

Free Forex Signals Free Forex Signal Forex Trading Signals Forex Strategies Forex Trading Strategies

No jobs, no buyers of stock index futures

No jobs, no buyers of stock index futures

Buyers went on strike after a massive two-week rally that likely forced most of bears to run for cover...just before reversing. This morning's dismal jobs numbers, or maybe lack of numbers, triggered a wave of liquidation ahead of an uncertain and long weekend.

Specifically, the U.S. economy added NO jobs last month to post the worst results in 11 months and the first time since 1945 that we've seen a flat-line. Although zero is better than a negative reading it was well below expectations and is certainly a thorn in the side of the bulls.

Yesterday's failure at 1230 was a bit of a clue as to how today might go, but when we mentioned the S&P could pull back as low as 1170 we weren't counting on in happening today. Although, looking back we should have guessed it...after all, holiday weekend, political chaos and a lack of confidence combined together will always trump fundamentals.

It is clear that the economy has hit a rough patch, and we highly doubt the recovery will be swift...but we also feel like many of the days issues have been given a bit too much credence. Nonetheless, emotional trade can prolong agony for long periods of time and history suggests we could get a full retest of the lows before things begin looking rosy on Wall Street again.

Our charts point toward 1170 being the "make or break" level and this leaves us relatively neutral and waiting for clearer waters next week. The way we see it, the bulls have a slight edge on Monday due to near-term technical support and possible optimism over the President's job plan (although we feel any optimism regarding a too little, too late plan will be unfounded). Also, if Tuesday comes around and it turns out to have been a tame three days off, investors might have had enough time to cool their heads and get back into the saddle.

If you are trading the September S&P, look for near-term support near 1166, 1144 and then 1109. Resistance on the way up will be 1189 and 1206.

* Due to time constraints and our fiduciary duty to put clients first, the charts provided in this newsletter may not reflect the current session data. However, market analysis and commentary does.

**Seasonality is already factored into current prices, any references to such does not indicate future market action.

Please note: An e-mini S&P and e-mini NASDAQ chart are used because they better for charting purposes, but trade recommendations can be applied to either the full-sized S&P or the mini. Unless otherwise noted, profit and loss will be based on the mini version.

Futures and Options Trading Recommendations

**There is unlimited risk in naked option selling and futures trading

Position Trade -

Flat

In other markets...

8-26- Clients were advised to sell October corn 820 calls for about 9 cents.

9-1 - Clients were instructed to take a quick profit, fills were reported near 3'6 to lock in a profit of about $263.50 before commission and assuming an entry of 9 cents.

9-2 - Clients were advised to sell the November 30-year bond 151 calls for 27 ticks or better.

(Our clients receive short option trading ideas in other markets such as gold, crude oil, corn, soybeans, Euro, Yen, and more. Email us for more information)

*All rights reserved. Reproduction or distribution of this newsletter without prior consent is strictly prohibited.

Source: http://www.fxstreet.com/fundamental/market-view/the-stock-index-report/2011-09-03.html

Global economy in ?danger zone? ? Zoellick

Source: http://feedproxy.google.com/~r/forexlive-rss/~3/yRsE3FPd2qk/

US credit downgrade and extension of the Fed's loose monetary policy

- Debt crises in Europe and the US have clearly weighed on confidence globally and the harsh fiscal austerity measures of governments in the OECD could produce further headwinds worldwide, benefiting the US dollar in the process. The euro, which has held firm despite a string of weak economic data has downside, particularly as sovereign debt problems, fiscal tightening and a likely looser monetary policy by the ECB eventually catch up to the common currency.

- Canada, though enjoying relatively healthy domestic fundamentals, is not an island unto itself and its growth will be restrained by a deterioration of the global economy. We have accordingly lowered our Canadian growth forecast for this year and next, prompting us to push our call for the next Bank of Canada rate hike to July 2012. That, and a weaker global outlook somewhat softens our near term outlook for the Canadian dollar.

- The Chinese yuan is on the ascendancy and is set to remain so in coming years as China attempts to rebalance growth towards its domestic economy. We expect the yuan to continue on a gradual appreciating path, with only a limited impact on Chinese exports.

Source: http://www.fxstreet.com/fundamental/analysis-reports/forex-currency-outlook/2011-09-02.html

Free Forex Signals Free Forex Signal Forex Trading Signals Forex Strategies Forex Trading Strategies

Forex Weekly Outlook ?September 5-9

This week?s most important events are the rate decisions in Australia, Japan, Canada, the UK and in the �Euro-Zone and employment data in Australia, �and Canada. Here is an outlook on all the major events awaiting us this week.

Last week the overall picture in the US has worsened after a flat reading of non-farm payrolls indicating no new Jobs were created in August. This is the weakest figure in almost a year, much lower than the 74,000 jobs expected by analysts. However, this reading was affected by the strike at Verizon artificially decreasing 45,000 jobs from the payrolls. Another positive sign is ADP report published two days ago, has shown a gain of 91K.

Let?s Start

- Australian rate decision:�Tuesday, 4:30. The Reserve Bank of Australia maintained the cash rate at 4.75% despite growing concerns over the growing inflation and global uncertainties. No changes are expected.

- US�ISM Non-Manufacturing PMI:�Tuesday, 14:00. ISM Non-manufacturing index decreased to52.7 in July after53.3 in the previous month. Indicating further growth but at a slower rate in the non-manufacturing sector. A small drop to 51.5 is expected.

- Australian GDP:�Wednesday, 1:30.Australia?s economy shrank in the first quarter by 1.2% following floods which affected exports. Exports plunged 8.7% subtracting 2.1 percentage points from GDP growth. Nevertheless the economy is expected to rebound in the second quarter. An expansion of 0.1% is predicted.

- Japan�rate decision:�Wednesday. The�Bank of Japan�held its�overnight call rate at a range of 0 to 0.1% by a unanimous vote. �However the BOJ has decided to increase the asset purchase program by 10 trillion to 50 trillion yen. � Further monetary easing is essential for a successful recovery according to BOJ members. The same rate is forecasted.

- Canadian Rate decision;�Wednesday, 13:00. The Bank of Canada left its overnight rate at 1.0%. Canada?s economic expansion is continuing in line with predictions with strong household spending but weaker experts due to reduced US demand. No changes are predicted.

- Australian employment data:�Wednesday, 1:30.�Australian economy did not add any jobs in July but contracted 100 positions. This reading was contrary to the 10,000 additional positions predicted by analysts. Full time employment dropped by 22,200 while part-time employment increased by 22,100. The unemployment rate climbed to 5.1% from 4.9% in the previous month. This rise in unemployment indicated that the boom from the global recovery has subsided. 10,400 new jobs are expected and Unemployment is predicted to remain 5.1%.

- UK�rate decision:�Thursday, 11:00. All MPC members voted to maintain interest rates at 0.5% which further distances the possibility of future rate hikes. Moreover a future quantitative easing plan was discussed as a possible option. Decreasing global demand and financial crisis in world markets will reduce inflation pressures. No change is foreseen.

- Euro-Zone rate decision:�Thursday, 11:45. European Central Bank has decided to keep interest rate at 1.50% and buy more Italian and Spanish sovereign bonds in order to fight the euro-zone debt crisis. The same rate is expected to be maintained.

- US Trade Balance:�Thursday, 12:30.�TheU.S. trade deficit widened to $53.1 billion in June from $50.8 billion in the previous month, the largest deficit in almost three years. This unexpected increase in deficit was contrary to predictions of a possible improvement to $48.2 billion. Exports as well as imports have declined. Deficit is expected to decrease to $49.7 billion.

- US Unemployment Claims:�Thursday, 12:30. New applications for unemployment dropped by 12,000 last week to 409,000. The average of new claims over the past four weeks increased to 410,250 indicating that the US job market is still weak.A further drop to 408,000 is predicted.

- Canadian employment data:�Friday, 11:00. Canada?s unemployment rate dropped to 7.2% percent in July, its lowest since December 2008, from in June, with improvement in job creation rising by 7,100 after 28,400 surge in the previous month. This is good news for the Canadian job market. An increase of 31,400 jobs is expected with an increase on Unemployment rate reaching 7.3%.

That?s it for the major events this week. Stay tuned for coverage on specific currencies

*All times are GMT.

Source: http://www.fxstreet.com/fundamental/market-view/forex-weekly-outlook/2011-09-03.html

DJ PRECIOUS METALS: Gold Jumps, Nears Record On US Jobs Report

Related Keywords: Metals

--Comex December gold rises $47.80 at $1,876.90 an ounce

--U.S. jobs growth stalls in August; unemployment rate remains at 9.1%

--Gold ends at second highest settlement, short of Aug. 22 record of $1,891.90

(Adds price table.)

By Matt Day Of DOW JONES NEWSWIRES

NEW YORK (Dow Jones)--Gold futures climbed Friday to within striking distance of last week's record highs as a weaker-than-expected reading on the U.S. labor market spurred investors to buy the metal as a store of wealth.

The most actively traded gold contract, for December delivery, rose $47.80, or 2.6%, to settle at $1,876.90 a troy ounce on the Comex division of the New York Mercantile Exchange, the second highest ending price for the most-active contract behind the record of $1,891.90 reached Aug. 22.

The U.S. economy didn't add jobs for the first time in almost a year in August, according to a closely watched report from the Labor Department, the latest sign that growth in the world's largest economy is stumbling. Nonfarm payrolls were unchanged last month, as a decline in government sector employment cancelled out a modest gain in private-sector jobs. Economists had expected an increase of 80,000 jobs on the month.

Some investors turn to gold during turmoil in other markets on the belief that it holds its value well during times of crisis. The jobs report news weighed on equities markets and growth-sensitive commodities such as crude oil and copper.

"We would not be surprised to see gold revisit fresh all time highs in the next few weeks," said Ross Norman, chief executive of London bullion dealer Sharps Pixley.

Friday's employment report followed recent weak readings on U.S. manufacturing and worker productivity, bolstering speculation that the Federal Reserve may take steps to stimulate the flagging economy. Such monetary easing would likely boost gold, market participants say, as it would further tarnish the outlook for the U.S. dollar.

"The fact that we have to look at additional easing obviously doesn't say much about the state of the economy," said Matt Zeman, head of trading with Kingsview Financial.

The metal's status as a currency alternative also continues to receive a boost as perceived safe-haven currencies face the prospect of long-term devaluation from accommodative monetary policy, said Bob Haberkorn, a market strategist with MF Global. In the short term, investors are wary of further intervention by the Bank of Japan or the Swiss National Bank in an effort to stanch the rise of those countries' currencies.

The precious metal climbed to record intraday highs above $1,900 an ounce last week as worries about sovereign-debt woes and slumping growth in the U.S. and Europe sent investors seeking gold as a store of value.

Renewed investor comfort with risky assets and worries that the gold market was becoming overheated after its steep climb sparked a reversal in the metal's fortunes last week, sending futures as low as $1,705 before the declines drew bargain buyers.

Gold spent much of this week shuffling in sideways trading as market players took positions ahead of Friday's jobs report.

Settlements (ranges include open-outcry and electronic trading): London PM Gold Fix: $1,875.25; previous PM $1,821.00 Dec gold $1,876.90, up $47.80; Range $1,826.90-$1,884.60 Sep silver $43.069, up 47.7 cents; Range $41.535-$43.500 Oct platinum $1,884.80, up $31.90; Range $1,847.00-$1,886.40 Dec palladium $783.20, down 7.20; Range $776.20-$794.80

-By Matt Day, Dow Jones Newswires; 212-416-4986; matt.day@dowjones.com

(END) Dow Jones Newswires

September 02, 2011 15:12 ET (19:12 GMT)

Copyright (c) 2011 Dow Jones & Company, Inc.

asdf View All Market Commentary

*Disclaimer: The information in the Market Commentaries was obtained from sources believed to be reliable, but we do not guarantee its accuracy. Neither the information nor any opinion expressed therein constitutes a solicitation of the purchase or sale of any futures or options contracts.

Source: http://feedproxy.google.com/~r/cmegroup/vrqy/~3/lICzgYPZBHQ/recap-metals_073.html

EURUSD and AUDUSD rotate lower, 2nd September 2011

Trading Setups / Chart in Focus:

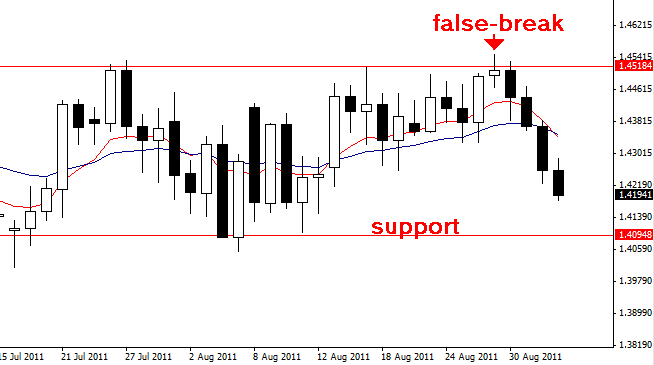

EURUSD

The EURUSD lost ground today for the fourth consecutive day. We can see price has rotated lower since making a false-break of resistance near 1.4500 ? 1.4550 on Monday.

We are seeing support coming in near 1.4100 ? 1.4000 and we will watch for daily price action strategies forming in this support area next week for a potential long setup in the context of this well-defined trading range, however, due to the recent sell-pressure we could also see a deeper move lower and so we would need to see an obvious reversal signal from support before considering any longs next week.

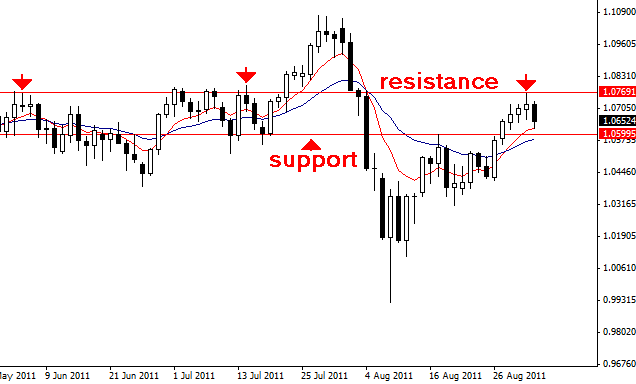

The AUDUSD rotated lower today after finding resistance at the 1.0770 horizontal level; we can see this level has been significant in the recent past. We can see 1.0600 support coming in just below, and we could see possible long signals forming here, until then we see sell pressure below 1.0770 resistance area.

Check out this cool new Forex trading lesson: A Controversial Forex Lesson on Forex Money Management & Measuring Your Trading Performance

For a more in-depth analysis of the major Forex currency pairs and price action analysis of more markets, please check out my Forex price action trading course.

Forex Commentary:

The euro shed 2.1 percent against the U.S. dollar this week, its worst week since the week ended July 10, while the dollar rose 0.1 percent against the yen

The euro is now up 6.1 percent against the dollar in the year to date, while the dollar is down 5.4 percent against the yen so far in 2011.

In other Friday trading, the GBPUSD was up 44 pips, the AUDUSD was down 68 pips, and the Canadian dollar hit a one-week low on Friday after the U.S. jobs report for August came in far weaker than expected, reigniting fears about a global growth slowdown and sending investors to safe-haven assets.

Other Markets:

On Wall Street today U.S. stocks lost 2 percent after a jobs report that showed zero jobs were added in August. This fueled investors? concerns about the potential for another recession.

The Dow lost 253.16 points, or 2.20 percent, the S&P 500 dropped 30.46 points, or 2.53 percent, and the Nasdaq lost 65.71 points, or 2.58 percent.

Upcoming important economic announcements: 9/5/2011

5th-8th: Britain ? Halifax HPI m/m

4:30am EST: Britain ? Services PMI

9:30pm EST: Australia ? Home Loans m/m

Source: http://www.fxstreet.com/technical/forex-strategy/forex-trade-setups-commentary/2011-09-03.html

Forex Trading Strategies Currency Trading Forex Signal Service Forex Currency

E.U. Bans Syrian Oil as Syrians Continue Protests

E.U. Bans Syrian Oil as Syrians Continue Protests

BEIRUT, Lebanon -- European Union members escalated the pressure on Syria's government on Friday by banning all imports of Syrian oil in response to its violent suppression of the nearly six-month-old uprising there. It was the most punitive action by the European Union to date over the crackdown in Syria, which sells nearly all its oil to Europe and relies heavily on that export income.

The new sanctions, which take effect on Saturday, came as antigovernment protesters in Syria demonstrated in a number of cities and towns -- including suburbs of Damascus -- despite a heavy presence of police officers and troops who, in some cases, outnumbered the protesters themselves. Activists and witnesses reported that 11 people were killed in the protests, which organizers called "the Friday of 'death before humiliation.'�"

The European Union, like the United States, has already prohibited Europeans from doing business with top Syrian officials, including President Bashar al-Assad and his close aides, to press him to end the crackdown. The uprising is the most serious challenge to his family's 40 years of autocratic rule.

Syria produces only about 400,000 barrels of oil a day, less than 1 percent of global production, and exports about 150,000 barrels a day, 95 percent of it to Europe. The exports provide about 25 percent of the Syria's income and are an important source of cash for the government, which has raised subsidies on fuel and food and increased government salaries to try to ease the unrest.

Syria's economy had already been hit hard by the effects of other sanctions and its growing isolation, with tourism, manufacturing and foreign investment all deeply depressed, and it is no secret that Syrian businesses are increasingly concerned about the country's future. The Damascus stock exchange index has fallen by nearly half since January, and there have been reports that the Central Bank began limiting withdrawals of foreign currency by bank customers in recent weeks, suggesting it is facing a cash shortage.

The new sanctions "will go straight to the heart of the regime," Foreign Minister Uri Rosenthal of the Netherlands said at a meeting of European Union foreign ministers in the Polish resort of Sopot, where the oil embargo was announced. Many of the ministers had attended the Friends of Libya conference in Paris on Thursday, aimed at helping Libya's new authorities navigate toward a stable state and resume its own oil production.

Catherine Ashton, the European Union foreign policy chief, said the ministers would discuss what other measures to take against Syria. "That is a conversation that keeps going on," she said.

Under the new prohibition, no member of the 27-member European Union can buy, import or transport oil and other petroleum products from Syria, or enter into financial or insurance services for such transactions, as of Saturday, although existing contracts can be fulfilled until Nov. 15.

Of European Union members, Austria was the most reliant on Syrian oil, importing about 8 percent of its total needs from that country, according to European Union officials in Brussels. Italy and Germany imported about 3 percent of their total crude oil from Syria, they said. The European Union also expanded its list of around 50 Syrians subject to an asset freeze and travel ban, adding four businessmen accused of financing the regime, diplomats said. Three companies were added to an existing blacklist of eight firms in Syria and Iran.

Alain Jupp�, the foreign minister of France, said that his country intended to increase contacts with the opposition in Syria and that "we will not let up on our efforts to bring an end to the repression and to secure a democratic dialogue."

More than 2,200 people have been killed in Mr. Assad's suppression of the revolt, the United Nations has said. Even Mr. Assad's closest foreign supporters, Russia and Iran, have urged him to take steps to mollify the protesters, who have been characterized by his government as terrorists and thugs under the influence of hostile foreign powers.

Some demonstrators on Friday rallied in support of Mohammed Adnan al-Bakhour, a top law enforcement official who resigned this week to distance himself from the crackdown. Mr. Bakhour, the attorney general of Hama, a focal point of the uprising, has been the highest-ranking official to resign since the demonstrations began.

All of the protests on Friday were held under the slogan "Death before humiliation."

"With today's slogan we wanted to tell the regime and the world that Syrians want freedom and dignity, not humiliation under the Assad regime," a protester who gave his name as Hassan said outside al-Hassan mosque in Damascus. "We prefer death to anything less than dignity and freedom."

Activists said that of the 11 deaths reported, four were in two Damascus suburbs, Irbin and Hamouriya, four in the restive city of Homs, and three in Deir al-Zour, a tribal region in eastern Syria along the Iraq border.

In the southern province of Dara'a, where the first protests erupted in March, women demonstrated in the town of Jassem, calling for the fall of the government. Some covered themselves in black shrouds to mourn those who have been killed.

In Damascus, activists said that small protests were held in the neighborhoods of Midan, Rukn Eddin, Qaboun and al-Hajar al-Aswad, and that outside some mosques, security forces outnumbered protesters.

"There were 300 protesters and 500 security men," said Mohamad, a 20-year-old protester from Qaboun. "And everyone demonstrating today knows that he might get killed, wounded or arrested," added Khalid, an activist from al-Hajar al-Aswad.

Nada Bakri reported from Beirut, and Steven Erlanger from Sopot, Poland. Reporting was contributed by Hwaida Saad from Beirut, Rick Gladstone from New York, and James Kanter from Brussels.

First published on September 3, 2011 at 12:01 am

Source: http://www.post-gazette.com/pg/11246/1172015-82-0.stm?cmpid=news.xml

Forex Strategies Forex Trading Strategies Currency Trading Forex Signal Service Forex

3 Advantages of Spread Trading

This article is taken from the YourTradingEdge magazine (MAY/JUN 2011 issue).

Jay Richards is a spread specialist in futures at Aliom Financial Markets. He owns and operates Just Spreads, a website dedicated to providing spread trade opportunities, market analysis, daily updates and continuing education across a select group of US and Australian futures spreads.

Spread trading is a powerful trading strategy that many retail traders have never heard of or know very little about. Too many investors associate spread trading with hedging and think its use is limited to banks and commercial traders. Spread trading began when markets were created, so risk could be hedged by primary users and transferred to another party. Banks and commercial traders know this and use it as their main trading strategy. They make money because they are risk averse and spread trading is their edge.

Spread trading has traditionally been applied to futures. The strategy requires a trader to hold a long and a short position simultaneously in the same or closely related markets. Since the introduction of CFDs, shares can be spread traded; this is commonly referred to as pairs trading. The CFD allows a trader to sell or be short a share in a leveraged manner similar to a futures contract. In each instance the trader is interested only in the price difference between the two contracts, as opposed to the outright price of the underlying futures or shares.

Source: http://www.fxstreet.com/education/trading-strategies/3-advantages-of-spread-trading/2011-08-31.html

Forex Trading Strategies Currency Trading Forex Signal Service Forex Currency

Friday, September 2, 2011

By request?

Copyright � 2011 ForexLive � Forex tools � Site Map � Log in

HIGH RISK WARNING: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives, experience level, and risk tolerance. You could lose some or all of your initial investment; do not invest money that you cannot afford to lose. Educate yourself on the risks associated with foreign exchange trading, and seek advice from an independent financial or tax advisor if you have any questions.

ADVISORY WARNING: FOREXLIVE provides references and links to selected blogs and other sources of economic and market information as an educational service to its clients and prospects and does not endorse the opinions or recommendations of the blogs or other sources of information. Clients and prospects are advised to carefully consider the opinions and analysis offered in the blogs or other information sources in the context of the client or prospect's individual analysis and decision making. None of the blogs or other sources of information is to be considered as constituting a track record. Past performance is no guarantee of future results and FOREXLIVE specifically advises clients and prospects to carefully review all claims and representations made by advisors, bloggers, money managers and system vendors before investing any funds or opening an account with any Forex dealer. Any news, opinions, research, data, or other information contained within this website is provided as general market commentary and does not constitute investment or trading advice. FOREXLIVE expressly disclaims any liability for any lost principal or profits without limitation which may arise directly or indirectly from the use of or reliance on such information. As with all such advisory services, past results are never a guarantee of future results.

Source: http://feedproxy.google.com/~r/forexlive-rss/~3/7FjF8Llv1pg/