Trading Setups / Chart in Focus:

EURUSD

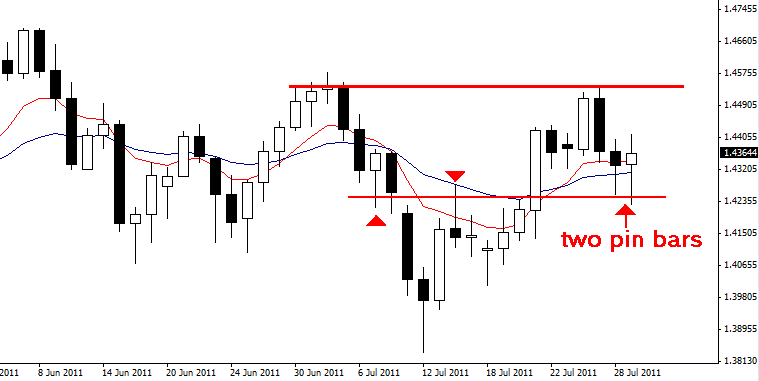

The EURUSD formed another bullish pin bar today showing rejection of the same short-term support near 1.4250 as yesterday?s pin bar.

This market basically moved sideways this week and seems to be consolidating before it makes its next strong directional move. The price action is looking slightly more buoyant to neutral than bearish, but we would elect to stand aside early next week until this market conditions become a little clearer.

Check out this cool new Forex trading lesson: Why You Don?t Need To Be Smart To Be a Trader

Forex Commentary:Lawmakers were still unable to reach an agreement on the U.S. debt ceiling on Friday, but there is no arguing that the dollar?s safe-haven appeal should remain trumped by the Swiss franc and Japanese yen.

The dollar on Friday hit a record low against the Swiss franc and a four-month trough against the yen, both traditional safe-haven currencies, as weak data on U.S. economic growth ignited fears the economy could slip into another recession.

?If the U.S. Treasury starts missing payments the FX market will begin to freak out, volatility will spike and liquidity will dry up,? said Greg Anderson, G10 strategist at CitiFX, a division of Citigroup in New York.

If the debt ceiling is raised but the deficit reduction measures are not big enough to avoid a ratings downgrade, this is already priced into the market and will not necessarily rattle the market, he said.

?A U.S. credit rating downgrade should lift the dollar because people will want to cut their exposure to risk and square their short dollar positions.?

Other Markets:

On Wall Street today stocks lost ground and ended the worst week in a year as time is running out for Washington to reach an agreement on a budget before the U.S. government loses its ability to borrow money.

The Dow lost 96.87 points, or 0.79 percent, the S&P 500 lost 8.39 points, or 0.65 percent, and the Nasdaq lost 9.87 points, or 0.36 percent.

Upcoming important economic announcements: 7/31/2011

9:00pm EST: China ? Manufacturing PMI

8/1/2011

4:30am EST: Britain ? Manufacturing PMI

10:00am EST: United States ? ISM Manufacturing PMI

6:45pm EST: New Zealand ? Labor Cost Index q/q

9:30pm EST: Australia ? Building Approvals m/m

Source: http://www.fxstreet.com/technical/forex-strategy/forex-trade-setups-commentary/2011-07-30.html

Forex Trading Signals Forex Strategies Forex Trading Strategies Currency Trading Forex Signal Service

No comments:

Post a Comment